Kdk Express Goods And Service Tax (Gst) Software

| Payment Terms | Others, Cash in Advance (CID) |

| Delivery Time | 1-3 Days |

| Main Domestic Market | All India |

Product Overview

Key Features

GSTR 9

a Get auto-calculated Data from GSTR 1, 2A and 3B

a Get a Easy and Clear Comparison of Books and Portal Data

a View Reports for each section to figure out any differences between Portal Data and Books Data

a View Multiple Reports of different sections in one go for easy comparison. Drag, Maximize and Minimize reports as per your needs to view Comparisons side by side

GSTR 9C

a View auto-populated details from GSTR 9

a Easy and Keyboard Friendly data entry

a Get a Clear Comparison of Books data entered by you and GSTR 9 Data

File Now GSTR-9/9C > GSTR-9/9c > GSTR-2A/2B

Get GSTR-2A/2B data of multiple months in a single click

a Invoice Wise Reconciliation

a Supplier Wise Reconciliation

a Excel Like Functionality with Linking or Delinking Invoices

a One page View of 2A & 2B

a Auto suggestions for invoice linking

a RCM and ITC Conflict Invoices view

a Get GSTR-2A data of multiple months in a single click

GSTR-3B

a Get 3B data auto-populated from R1 and 2B

a Multiple Validations and Business Rules for easy and early identification of errors and warnings so that you file only correct data with 100% accuracy.

a Get to know if you have Claimed any Excess ITC or if their is any Probable Liability u/s 75 (12) so that you can take proper actions.

a ITC set-off as per amended rules and sections.

a Keyboard friendly data preparation.

a 100% Accurate filing a Single click to auto-fill GSTR-3B with GSTR-1 & GSTR-2B data

a Claim 100% ITC a Check ITC as per GSTR-2B while preparing GSTR 3B

GSTR-3B GSTR-1

a Import data in a single click from Tally & Excel

a View Consolidated GSTR-1 Summary of all the sections on a single page.

a Party-Wise & Section Wise segregation of GSTR-1 Data

a Validation engine (with 100+ checks) for early identification of errors.

a Facility to Import data from Tally & Excel.

Why use Express GST Software

Super Fast Return Preparation and Advanced 2A/2B Reconciliation

To ensure that your time and efforts are saved and you are able to claim maximum ITC

Saves Time

Save Time with Simple UI and smarter reports at 7X Speed

Trusted brand of 1.5 Lakh+ users

By KDK Softwares a Widely Used Software for Tax Filing

Intuitive User Interface

Simple & Beautiful User Interface to Take Quick Decisions

Multi Login Simultaneously

Multiple Users can login at same time and work

Advanced Reports

Net Tax Liability (R1 & 2A), Cash & Credit Ledger Balance, Tax Liability and ITC Availability

Pull GSTR-2A / GSTR-2B and historical GSTR-1 and 3B invoices

Get historical invoices from 2A report and even earlier filings with GSTR-1 and 3B

Pull at GSTIN or PAN level, across months and years

Select all GSTINs under a single PAN and pull invoices from GSTN since the inception of GST Act.

Pull without interruption at scale

Month-end? Large invoice count? Our reliable architecture ensures you can pull invoices seamlessly.

100% accurate, designed by inhouse tax experts

Cloud based platform

From the convenience of home or office, through any de-vice with secure logins.

Company Details

KDK has created a landmark journey in the Tax compliance industry by not only offering Specialized Tax Software Solutions, but also by providing the services to the customers.

- KDK Softwares, a leading tax compliance software company and with more than 11/2 decades of substantial market presence, KDK Software has evolved to become one of the fastest-growing and most respected brand in the Indian Taxation industry by providing reliable and cost-effective software solutions to Corporates, PSUÃA ¢ÃA ÂA ÃA ÂA s, Tax professionals & CA Firms.

Cloud Tax Filing Software:

ExpressGST - ExpressTDS

- ExpressITR

- ExpressRECO

ÃA

Business Type

Service Provider, Supplier, Trading Company, Producer

Employee Count

200

Establishment

2006

Working Days

Monday To Saturday

GST NO

08AACCK2621G1ZV

Payment Mode

Cash on Delivery (COD)

Seller Details

K.D.K. Softwares (India) Pvt. Ltd.

GST

08AACCK2621G1ZV

Marketing / Sales

Mr Rahul Sharma

Address

"Goyal Villa", A-40, Shyam Nagar, Jaipur, Rajasthan, 302019, India

gst software in JaipurReport incorrect details

Related Products

Commerical GST Software

Price - 21000 INR (Approx.)

MOQ - 1 Unit/Units

FAIRSYS INFO TECH PRIVATE LIMITED

Pune, Maharashtra

GST Software

Price - 15000 INR (Approx.)

MOQ - 1 Unit/Units

PERENNIAL CODE IT CONSULTANTS PRIVATE LIMITED

Hyderabad, Telangana

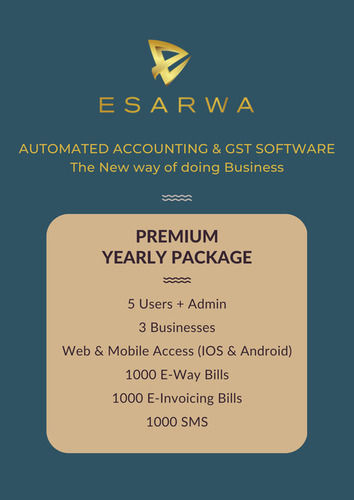

Esarwa Accounting Billing Inventory GST Software

Price - 2221 INR (Approx.)

MOQ - 1 Piece/Pieces

MYRAH CONSULTING SERVICES PRIVATE LIMITED

Mumbai, Maharashtra

GST Software Development Services

Price - 56000 INR (Approx.)

MOQ - 1 Unit

CLOUDEDOTS TECH LLP

Rajkot, Gujarat

More Products From This Seller

Explore Related Categories

- Tradeindia

- Software

- Gst Software

- Kdk Express Goods And Service Tax (Gst) Software In Shyam Nagar

Recommended Products

Popular Products

Human HairForklift TrucksServo Voltage StabilizerBasmati RiceBackhoe LoaderCarry Bag Making MachineDrum LifterElectric StackerScissor LiftsIndustrial Vibrating ScreenRotameterFlowmeterRotary Air CompressorIndustrial Eto SterilizerRice Packaging MachinesShredding MachineHammer MillAutomatic Labelling MachineDiesel ForkliftAerial Work PlatformStorage Rack SystemEpoxy ResinMild Steel BarStainless Steel SheetsStainless Steel StripsBag Filling MachinesAsphalt PlantsSlat ConveyorOintment PlantPlanetary MixersLadies KurtisLed LightsCctv CameraBall ValveAnti Cancer MedicineAir CompressorIncense SticksSolar LightsGoods LiftsVitrified TilesStainless Steel CoilsPvc PipesPvc Pipe FittingsUpvc PipesUpvc Ball ValvePipe Elbows