Tara Devi Face Brass Statue

Price: 550 TO 900 INR

Get LatestPrice

| Finishing | Polishing |

| Regional Style | Indian |

| Theme | Hinduism |

| Color | COPPER |

| Technique | Polished |

Product Overview

Key Features

We Export, Distribute, Trade and Supply of Tara Devi Face Brass Statue in Noida, Uttar Pradesh, India. This beautiful Brass Statue figurine is a wonderful gifting option for your best friend on her housewarming party & home.Hand crafted showpiece is being made by traditional methods. Enhance your home and garden by these graceful Brass figurines of tribal ladies playing different musical Instruments. A very attractive & designer tribal art statue which is hand crafted in brass with fine Coral and Turquoise stones, finely placed all over the piece.

Product Specifications

| Finishing | Polishing |

| Regional Style | Indian |

| Theme | Hinduism |

| Color | COPPER |

| Technique | Polished |

| Wood Type | Other |

| Metal Type | Brass |

| Product Type | Decoration |

| Fabric Type | Other |

| Width | 4 Centimeter (cm) |

| Height | 15 Centimeter (cm) |

| Length | 10 Centimeter (cm) |

| Size | 15*10*4 |

| Material | Other |

| Style | Religious |

| FOB Port | KOLKATA |

| Payment Terms | Paypal, Others, Western Union, Delivery Point (DP), Cash Against Delivery (CAD), Cash in Advance (CID), Cheque, Cash Advance (CA) |

| Supply Ability | 1000 Per Week |

| Delivery Time | 4 Week |

| Sample Policy | Contact us for information regarding our sample policy |

| Packaging Details | 20*15*8 |

| Main Export Market(s) | Australia, Central America, North America, South America, Eastern Europe, Western Europe, Middle East, Asia, Africa |

| Main Domestic Market | All India |

| Certifications | Although the packing list means the details of packing, most of the details of invoice also must be mentioned as per the specified format.1. Exporter /Consigner : The details of party who consigns the goods is mentioned in this column. The name and complete address of consignor to be mentioned with Country name.2. Consignee: The details of party to whom the consignment is shipped out to be mentioned. Normally, the details of overseas buyer is mentioned. In some cases, when Letter of credit involves, the bank name is mentioned as consignee starting with aEURoeTo the order ofaEUR|aEUR If the cargo is re-sold at destination to a third party, said column can be mentioned as aEURoeTo OrderaEUR3. Buyer: In some cases, consignee may not be the actual buyer. Then the details of buyer other than the consignee is mentioned.4. Invoice Number and date: This number is the serial number of sale transaction used by a seller. This reference number is quoted at many occasions including authorities to identify the consignment for future reference. This is the reference number against the said sale used internally by the buyer in all future reference and files in office also.5. BuyeraEURtms order number and date: The purchase order number of overseas buyer is mentioned here. If the shipment is under Letter of credit, the LC number and date is mentioned.6. Other reference if any: You can mention any other reference number to be declared in related to the said shipment or common.7. Country of Origin: The country of goods originally manufactured to be mentioned in this column. In some of the cases, the goods are imported to a country and the same goods are exported after re-packed and re-balled. It happens in triangular shipments also. Read more about aEUR~triangular shipmentaEURtm in my previous article.8. Country of final destination: This is the country where the goods are finally reached.9. Vessel / Flight: The name of vessel or flight if available. You can also mention the planning vessel or planning flight name. While mentioning vessel name, always write voyage number.10. aEUR~Pre carriage byaEURtm: The term aEURoePre carriage byaEUR means, the mode of movement of cargo to port of loading by the shipper. The Pre carriage can be aEUR~By roadaEURtm, aEUR~By RailaEURtm aEUR~By airaEURtm or aEUR~By seaaEURtm.11. Place of Receipt: Place of receipt of goods by carrier after completing export customs procedures. If you (exporter) are situated far from load port, the cargo can be customs cleared at nearest Container Freight station and move to port of loading. If you are completing customs procedures near the load port, the column aEUR~place of recieptaEURtm and aEUR~port of loadingaEURtm will be the same.12. aEUR~Port of LoadingaEURtm You can mention the port of loading of goods. It can be airport or sea port of place where you load your goods to aircraft or vessel. 13. Port of Discharge: This is the port where your goods are unloaded from the aircraft or ship to deliver to the buyeraEURtms place. Be alert, the port of discharge column should be filled up with best care. If you handle documentation for different shipments at time, there are chances to get interchanged the port of discharge column. You can imagine, what happens if the same got changed. Shipping Bill is prepared on the basis of Invoice to file with customs clearance procedures. Bill of Lading is prepared on the basis of customs clearance completed shipping bill. Once Bill of Lading released with the change of port of discharge, your cargo will reach to destination where you mentioned aEUR~the port of dischargeaEURtm in the Invoice.14. Place of Delivery: If your buyer is located far from port of discharge and he need to get the goods near to customs supervised ware house (Container freight station CFS), the Bill of Lading issued at port of 1. Exporter /Consigner : The details of party who consigns the goods is mentioned in this column. The name and complete address of consignor to be mentioned with Country name.2. Consignee: The details of party to whom the consignment is shipped out to be mentioned. Normally, the details of overseas buyer is mentioned. In some cases, when Letter of credit involves, the bank name is mentioned as consignee starting with aEURoeTo the order ofaEUR|aEUR If the cargo is re-sold at destination to a third party, said column can be mentioned as aEURoeTo OrderaEUR3. Buyer: In some cases, consignee may not be the actual buyer. Then the details of buyer other than the consignee is mentioned.4. Invoice Number and date: This number is the serial number of sale transaction used by a seller. This reference number is quoted at many occasions including authorities to identify the consignment for future reference. This is the reference number against the said sale used internally by the buyer in all future reference and files in office also.5. BuyeraEURtms order number and date: The purchase order number of overseas buyer is mentioned here. If the shipment is under Letter of credit, the LC number and date is mentioned.6. Other reference if any: You can mention any other reference number to be declared in related to the said shipment or common.7. Country of Origin: The country of goods originally manufactured to be mentioned in this column. In some of the cases, the goods are imported to a country and the same goods are exported after re-packed and re-balled. It happens in triangular shipments also. Read more about aEUR~triangular shipmentaEURtm in my previous article.8. Country of final destination: This is the country where the goods are finally reached.9. Vessel / Flight: The name of vessel or flight if available. You can also mention the planning vessel or planning flight name. While mentioning vessel name, always write voyage number.10. aEUR~Pre carriage byaEURtm: The term aEURoePre carriage byaEUR means, the mode of movement of cargo to port of loading by the shipper. The Pre carriage can be aEUR~By roadaEURtm, aEUR~By RailaEURtm aEUR~By airaEURtm or aEUR~By seaaEURtm.11. Place of Receipt: Place of receipt of goods by carrier after completing export customs procedures. If you (exporter) are situated far from load port, the cargo can be customs cleared at nearest Container Freight station and move to port of loading. If you are completing customs procedures near the load port, the column aEUR~place of recieptaEURtm and aEUR~port of loadingaEURtm will be the same.12. aEUR~Port of LoadingaEURtm You can mention the port of loading of goods. It can be airport or sea port of place where you load your goods to aircraft or vessel.13. Port of Discharge: This is the port where your goods are unloaded from the aircraft or ship to deliver to the buyeraEURtms place. Be alert, the port of discharge column should be filled up with best care. If you handle documentation for different shipments at time, there are chances to get interchanged the port of discharge column. You can imagine, what happens if the same got changed. Shipping Bill is prepared on the basis of Invoice to file with customs clearance procedures. Bill of Lading is prepared on the basis of customs clearance completed shipping bill. Once Bill of Lading released with the change of port of discharge, your cargo will reach to destination where you mentioned aEUR~the port of dischargeaEURtm in the Invoice.14. Place of Delivery: If your buyer is located far from port of discharge and he need to get the goods near to customs supervised ware house (Container freight station CFS), the Bill of Lading issued at port of loading has to be mentioned the said place of delivery. Once goods unloaded at port of discharge by ship or aircraft, the cargo is moved to the said location. This is the place where importer files customs documents for import and take delivery of cargo. In other words, responsibility of carrier to deliver the goods is up to this place. Importer has to move the goods from place of delivery to final destination of goods at his cost.15. Terms of Delivery & Terms of Payment: As I have explained in previous articles, the terms of delivery like EX-WORKS,FOB,C&F,C&I,CIF,DDU,DDP etc. as agreed both you and your buyer. Terms of Payment also as explained earlier like LC,DA,DP etc.16. Marks and number: The details of aEUR~markingaEURtm you have done on parcels to be exported. Also the number mentioned on the parcel. Suppose you have 10 packages to be exported. You have labeled or marked as 1,2,3,aEUR|.10 serial numbered on each parcel , and written complete address of consignee and your address under respective heads. Here, you write marks and numbers as, aEURoe01 aEUR" 10aEUR aEURoeAs addressedaEUR in the column of aEUR~marks and numbersaEURtm. The proper marking and labeling is very important while shipping less container load (LCL).17. Number and kind of packages: In this column, you need to mention the total number of packages in the said particular shipment. If you export total 10 packages you can mentioned 10. As you know, there are various kinds of packaging modes. For example: wooden box, drums, corrugated carton boxes, pallets etc. depends up on the nature of cargo. So you can mention the mode of packages you packed the said 10 parcels. If you have packed the said 10 parcels as pallets, you can mention the column of aEUR~number and kind of packagesaEURtm as aEURtm10 palletsaEURtm.18. Description of Goods: The Description details of goods are mentioned in this column. Also be alerted that if the shipment is under Letter of Credit, the words mentioned on LC to be matched exactly with your words in documents. I personally suggest, if any spelling error occurred while releasing Letter of credit, let the same spelling error be in the documentation if not changing the meaning of whole body of description. By this statement, I would like to make you remember once again about the importance of accuracy to be maintained in documentation matching with the words of Letter of Credit.loading has to be mentioned the said place of delivery. Once goods unloaded at port of discharge by ship or aircraft, the cargo is moved to the said location. This is the place where importer files customs documents for import and take delivery of cargo. In other words, responsibility of carrier to deliver the goods is up to this place. Importer has to move the goods from place of delivery to final destination of goods at his cost.15. Terms of Delivery & Terms of Payment: As I have explained in previous articles, the terms of delivery like EX-WORKS,FOB,C&F,C&I,CIF,DDU,DDP etc. as agreed both you and your buyer. Terms of Payment also as explained earlier like LC,DA,DP etc.16. Marks and number: The details of aEUR~markingaEURtm you have done on parcels to be exported. Also the number mentioned on the parcel. Suppose you have 10 packages to be exported. You have labeled or marked as 1,2,3,aEUR|.10 serial numbered on each parcel , and written complete address of consignee and your address under respective heads. Here, you write marks and numbers as, aEURoe01 aEUR" 10aEUR aEURoeAs addressedaEUR in the column of aEUR~marks and numbersaEURtm. The proper marking and labeling is very important while shipping less container load (LCL).17. Number and kind of packages: In this column, you need to mention the total number of packages in the said particular shipment. If you export total 10 packages you can mentioned 10. As you know, there are various kinds of packaging modes. For example: wooden box, drums, corrugated carton boxes, pallets etc. depends up on the nature of cargo. So you can mention the mode of packages you packed the said 10 parcels. If you have packed the said 10 parcels as pallets, you can mention the column of aEUR~number and kind of packagesaEURtm as aEURtm10 palletsaEURtm.18. Description of Goods: The Description details of goods are mentioned in this column. Also be alerted that if the shipment is under Letter of Credit, the words mentioned on LC to be matched exactly with your words in documents. I personally suggest, if any spelling error occurred while releasing Letter of credit, let the same spelling error be in the documentation if not changing the meaning of whole body of description. By this statement, I would like to make you remember once again about the importance of accuracy to be maintained in documentation matching with the words of Letter of Credit. Hope you followed me.19. Remarks20. Dimension21. Net weight22. Gross weight23. Declaration: While declaring and signing the invoice means, you are stating all information given in packing list is true. The words of declaration mentioned in the invoice may differ from country to country based on their respective law.24. Authorized signatory, rubber stamp and Date : Means, the person signs on invoice with rubber stamp of the firm. Authorized signatory means, the person to who the exporter authorize to sign invoice on behalf of the exporter. |

Explore in hindi - तारा देवी फेस ब्रास स्टैच्यू

Company Details

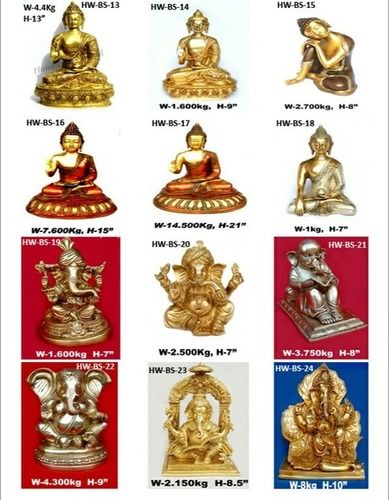

Kav Retail Services, Established in 2016 at Noida in Uttar Pradesh, is a leading Exporter,Supplier,Trading Company,Retailer of God & Goddess Statues in India. Kav Retail Services is one of Trade India's verified and trusted sellers of listed products. With extensive experience in supplying and trading Tara Devi Face Brass Statue, Kav Retail Services has made a reputed name for itself in the market with high-quality Brass Buddha Head Statue, Brass Buddha Statue, Brass Handcrafted Ganpati Murti, etc.

Focusing on a customer-centric approach, Kav Retail Services has a pan-India presence and caters to a huge consumer base throughout the country. Buy God & Goddess Statues in bulk from Kav Retail Services at Trade India quality-assured products.

Focusing on a customer-centric approach, Kav Retail Services has a pan-India presence and caters to a huge consumer base throughout the country. Buy God & Goddess Statues in bulk from Kav Retail Services at Trade India quality-assured products.

Business Type

Exporter, Supplier, Trading Company, Retailer

Employee Count

15

Establishment

2016

Working Days

Monday To Sunday

GST NO

09AAQFK3418G1Z4

Payment Mode

Cash on Delivery (COD), Cash in Advance (CID)

Seller Details

K

Kav Retail Services

GST

09AAQFK3418G1Z4

Rating

4

Partner

Mr. Abhishek Arya

Address

B No. B-67, Second Floor, Sec-65, Noida, Uttar Pradesh, 201301, India

religious brass idols in NoidaReport incorrect details

Related Products

More Products From This Seller

Explore Related Categories

- Tradeindia

- God & Goddess Statues

- Religious Brass Idols

- Tara Devi Face Brass Statue In 65-sector

Recommended Products

Popular Products

Human HairForklift TrucksServo Voltage StabilizerBasmati RiceBackhoe LoaderCarry Bag Making MachineDrum LifterElectric StackerScissor LiftsIndustrial Vibrating ScreenRotameterFlowmeterRotary Air CompressorIndustrial Eto SterilizerRice Packaging MachinesShredding MachineHammer MillAutomatic Labelling MachineDiesel ForkliftAerial Work PlatformStorage Rack SystemEpoxy ResinMild Steel BarStainless Steel SheetsStainless Steel StripsBag Filling MachinesAsphalt PlantsSlat ConveyorOintment PlantPlanetary MixersLadies KurtisLed LightsCctv CameraBall ValveAnti Cancer MedicineAir CompressorIncense SticksSolar LightsGoods LiftsVitrified TilesStainless Steel CoilsPvc PipesPvc Pipe FittingsUpvc PipesUpvc Ball ValvePipe Elbows